For years, Verizon was the biggest cheerleader for 5G in mmWave spectrum. It deployed more mmWave 5G cell sites than any other mobile operator and persuaded its handset partners to support mmWave. But by 2022, all that Verizon executives wanted to talk about was their progress with C-band. Was this the end of 5G in mmWave? Not quite.

5G works in a wide range of frequencies from 600 MHz to 42 GHz. The lower the frequency, the fewer the number of cell sites a mobile operator needs to cover a certain area. It is therefore rational for an operator to use its lowest available spectrum to offer “nationwide coverage”. However, as the number of subscribers on the network and the data consumed per subscriber skyrockets, operators must use spectrum in higher frequency bands, such as mmWave, to add capacity.

5G networks are built in layers. Mid-band is now. Millimeter Wave is next.

The Path to Widespread Adoption

In 2020 or 2021, there was no need for 5G capacity. However, mmWave 5G deployments in this period demonstrated that mmWave networks could provide gigabit speeds with sub-10 ms latency. They proved that smartphones and home internet gateways could support mmWave. They showed the world what is possible with mmWave 5G.

As we enter 2023, I remain confident about the potential of mmWave 5G, and believe that investment in this segment will pick up steam by 2025. There are three reasons:

Emergence of Fixed Wireless Access (FWA) as the primary use case for 5G

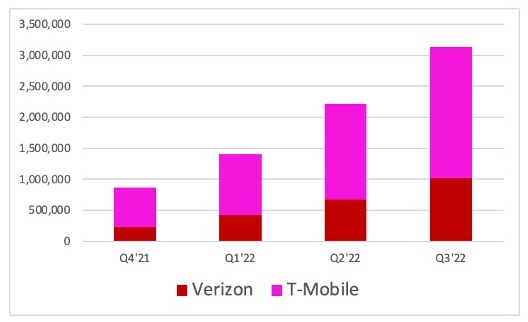

I have long argued that FWA will be the first, big revenue generating application of 5G, its “killer app”. T-Mobile and Verizon proved this, by convincing almost 3 million US households and businesses to switch from their existing ISP to a 5G-based alternative within 12 months of launching service. Both operators claim that this is just the start, and they will each have 7–8 million FWA subscribers within the next 5 years.

T-Mobile and Verizon had acquired 3 million FWA subscribers by September 2022

Interest in FWA is not limited to the US. Reliance Jio, India’s largest mobile operator, has set a target of acquiring more than 100 million FWA subscribers. Ericsson, in its November 2022 Mobility Report, has forecasted 300 million FWA subscribers globally by 2028.

Though FWA is a source of new revenue for mobile operators, it requires a massive amount of network capacity. According to the 3Q22 OpenVault Broadband Insights (OVBI) Report, an average US home Internet user consumed 495.5 GB per month, 30 times more than what an average US smartphone user consumed. So far, 5G operators are offering home Internet service only where their mobile network has spare capacity. This is a great way to enter the market, but not one that supports long-term growth. As the number of subscribers grow, 5G operators will have to build dedicated network capacity for FWA, and I believe this new capacity is best built using abundant and inexpensive mmWave spectrum.

mmWave-only client devices (UEs) are on the horizon.

Until now, mmWave spectrum has played second fiddle to sub-6 GHz bands, even for applications like fixed wireless or private networks where it can stand on its own feet. This is because all commercially available mmWave devices require a sub-6 GHz “anchor” and operated in “dual-connectivity” mode (called “EN-DC” or “NR-DC”). This means that an operator or an enterprise can use mmWave spectrum only if they have a sub-6 GHz network, as an add-on.

In late 2022, Qualcomm, the leading supplier of 5G UE chipsets, announced the availability of software that enables its X65 (and future, X75 chipsets) to operate in mmWave-only mode, enabling its customers to offer mmWave-only client devices by late 2023.

mmWave-only client devices will make it possible for

– Mobile operators to build a dedicated FWA network in mmWave bands, unencumbered by the requirements of their mobile network.

– Internet service providers (ISPs) that do not have a mobile network can now use mmWave 5G to expand their footprints. This is particularly attractive in countries like Germany where mmWave spectrum is available to anyone that is willing to use it for a reasonable fee.

– Enterprises to use mmWave spectrum for private networks. Many countries offer mmWave spectrum for private 5G already, and in others, mobile operators may be willing to lease their mmWave spectrum to enterprises.

Growing global availability of mmWave spectrum for 5G

Throughout 2022, the number of countries where mmWave spectrum is available for 5G continued to grow. By the end of 2022, 20 countries with more than 20% of the world’s mobile subscribers had made mmWave spectrum available for 5G. This increases the total addressable market for mmWave 5G, creates incentives for R&D investment, and strengthens the ecosystem.

India, for instance, made 2,200 MHz of mmWave spectrum available to mobile operators in mid-2022. With a population of 1.3 billion and very low fixed Internet penetration, India is likely to become the largest FWA market in the world, creating immense possibilities for mmWave 5G. In the late December 2022, Spain licensed mmWave spectrum making it the third large European country to make mmWave spectrum available for 5G, after Italy and Germany. The UK regulator, Ofcom, has started a consultation on how mmWave spectrum in 26 and 40 GHz should be licensed, and is likely to make spectrum available for both, exclusive use and shared use in 2023.

Bullish on 5G Capacity. Bullish on mmWave 5G.

Even though the 5G icon lights up on smartphones carried by almost a billion subscribers today, it is still early days for 5G. Today’s 5G networks are being used for yesterday’s applications, like watching video on smartphones or accessing the Internet at home. There are no applications that would not exist if 5G did not. But all this can change rapidly if the massive investment in mass-market extended reality devices and associated content and applications bears fruit. Once these new devices and applications make it market, 5G networks will need orders of magnitude more capacity, very high speeds, and millisecond latency. In other words, mmWave 5G.

Recent Comments